Trustcommerce & Health iPASS

Health iPASS Gets

Your Practice Paid

Offer A Better Patient Payment Experience

Deliver the best patient payment services experience with Health iPASS, the market-leading patient intake and digital patient engagement software.

With Health iPASS integrated through TrustCommerce, collect more patient dollars while improving patient engagement from pre-arrival to final payment.

By simplifying the check-in, intake, and patient payment processes, Health iPASS, a beautifully designed and user-friendly mobile patient engagement platform, lets patients know what they owe and can make payments with ease via a multi-channel software interface.

Health iPASS is committed to delivering better check-ins for patients and better revenue for medical practices through a game changing digital patient engagement platform.

Health iPASS Payment Features

Solutions for every stage of the patient journey!

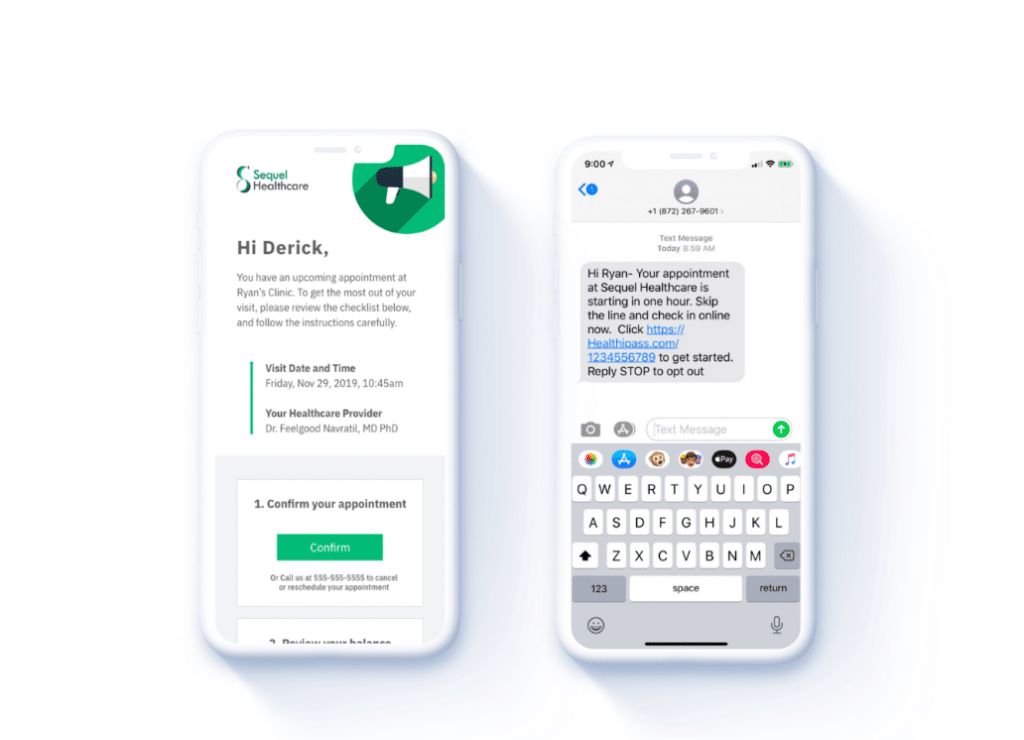

PRE-ARRIVAL

- Touch-free, 100% mobile check-in and intake

- Customizable digital forms

- Interactive appointment reminders

- AI-driven insurance verification

- Cost estimator tools

POINT-OF-SERVICE

- 60-second self-serve or assisted check-in

- Clear review of benefits

- Clear, consistent, and easy collection of payments

- Ability to secure a card-on-file for automatic payment of residual balances

- Automatic posting of patient payments and demographic updates

- In-clinic digital forms management

- Digital receipts

Post-visit

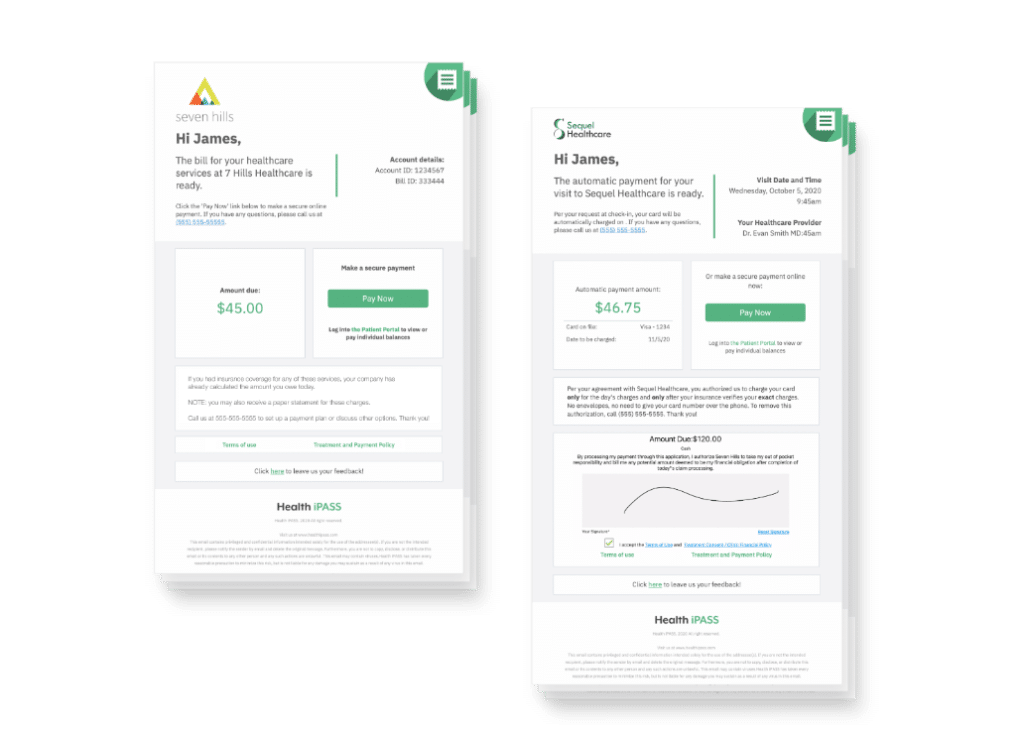

- Automated electronic billing & billing reminders

- Auto-debiting of residual patient balances

- Automated billing reminders

- One-time payments & payment plans

- Online bill pay portal

- Flexible payment plans

- Post-visit surveys

Contact TrustCommerce for more information

Explore All The Health iPASS Platform Has To Offer